TAKE YOUR POWER BACK!

Get a Quick Quote Today!

Join Our Ambassador Program and Earn $1,000 For Every Installed Referral!

Great For Nonprofits, Sports Teams, Schools, And Of Course Individuals!

SOLAR SOLUTIONS

OUR MAIN SOLAR PARTNER POWUR:

Financially Secure: Investor backed and Member owned

Experienced: Over 10,000 successful installations

Doing Well By Doing Good: Fully certified B-Corp

Validation: Inc. 5000 Fastest Growing Company in America

Impact Focused: Money from every installation goes to preserving millions of acres of the Amazon rainforest

Record Breaking: First solar company to offset 100% of the emissions from the solar manufacturing process

30 Year Warranty Including Roof Penetrations, Inverters, and Panels!

BY THE NUMBERS

220+

Pending Installs

422+

HAPPY

CUSTOMERS

23

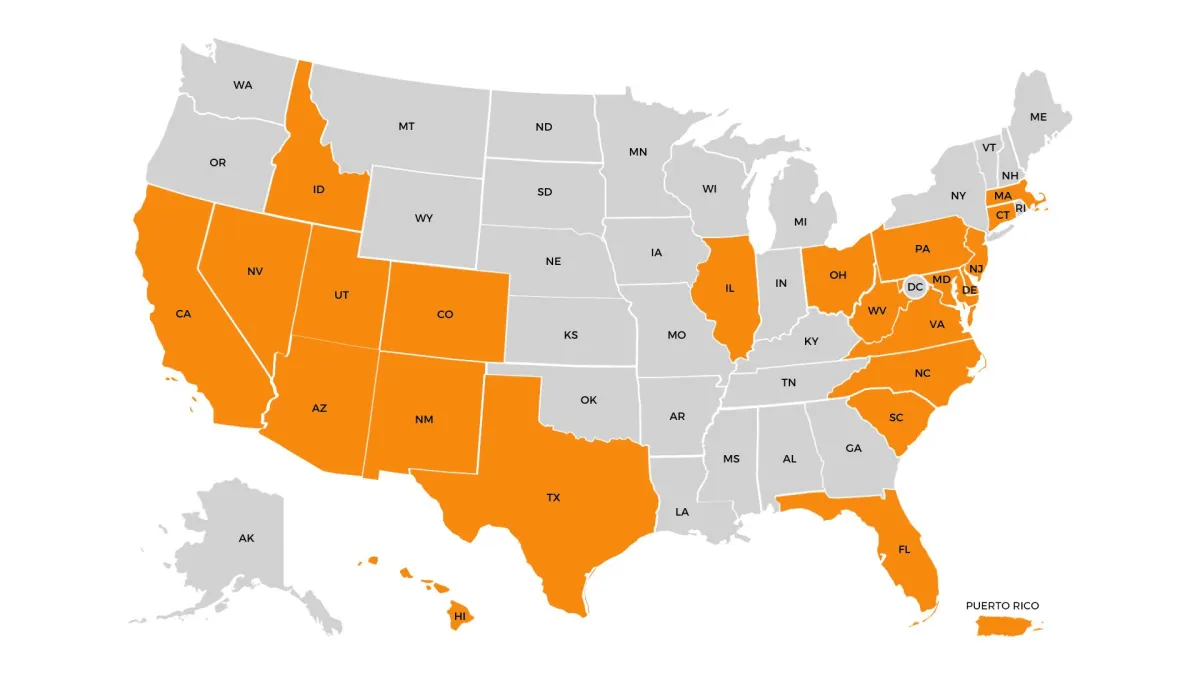

STATES

COVERED

$200,000+

AMBASSADOR PAYOUT GOAL FOR '24

OUR COVERAGE MAP

IT'S A SIMPLE PROCESS...

Collect Your Energy Bill

Review a Custom Proposal

Select the Best Plan

Sign Contract

Get Started

AMBASSADORS

Make $1,000 Per Installed Solar Deal That Is Referred

Receive Your Own Websites To Advertise

Help Friends and Family Get Good Deals on Solar With The Industry Leading Warranty

Nonprofits May Join To Become an Ambassador To Receive $1,000 Donations!

CONTACT US

CALL/TEXT: 951.837.5830

E-MAIL: SPENCER@FRAZIERS.COM